Awards are in place, trophies are ordered, program is being finalized, and sponsors are in. Did you make your reservation for the biggest insurance event of the year? If not, click HERE! or go to www.naifala.org

THURSDAY, FEBRUARY 18, 2021

11:30 a.m. - 1:30 p.m. by Zoom

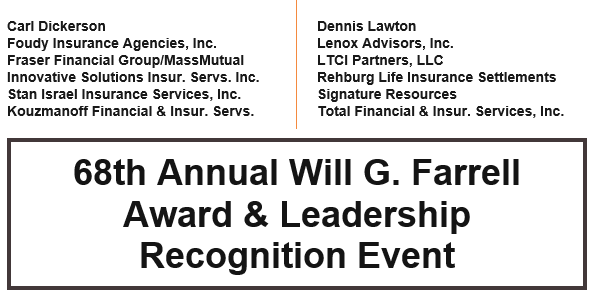

And, speaking of sponsors, a BIG thank you to the following sponsors of the 2021 Will G. Farrell Awards Event. We greatly appreciate your support of this event!

Thank you, thank you, thank you!!!

Keynote Speaker: Ramona Neal, CLU, ChFC, CLTC, REBC

"The Good And The Bad Of The #1 Trend In The Life Insurance Industry: Chronic Illness Riders"

*What You Don’t Know Can Hurt You And Your Clients.*

Description of Presentation:

-

How living benefit solutions (Hybrids, Chronic illness, Critical Illness, and LTC riders) have revolutionized the life insurance industry and have grown to become the #1 trend in the last 15 yrs (In 2019, per LIMRA, these account for 30% of all individual life premiums)

-

LTC Life insurance solutions continuum: Understanding the Differences (some offer rich benefits and are deemed qualified LTC with ability to extend beyond the death benefit, some are riders on life insurance with the potential to only accelerate a fraction of the death benefit)

-

Difference between LTC riders and Chronic Illness Riders

-

Difference between Chronic Illness riders and Critical Illness riders

-

Difference between Chronic Illness riders with monthly charges vs Chronic Illness riders with charge and benefit amount determined at acceleration

-

Risks: (a) pending precedent setting litigation (b) lack of regulations and no agreed upon standardizations on disclosure from insurers (c) naming convention

-

Teach them how to fish: How to know what you already sold and what you are currently selling?

-

Moving forward - Best practices for insurers and insurance professionals

-

(a) illustrations should reflect how widely accelerated benefits can vary ($) based on age and severity of condition (b) need fair & balanced examples in advisor/consumer literature that are not cherry picked to maximize payouts (c) disclosure of pertinent non-guaranteed elements such as: the right for insurer to reduce benefit amount or the requirement for the condition to be permanent or the fact that only facility care is covered

-

Important: All the riders are Good riders. The problem isn’t the riders. The problem is - are we adequately disclosing how they work?

About the speaker: Ramona Neal, CLU, ChFC, CLTC, REBC, has 29 years of experience in the life insurance industry with roles in field sales, competitive intelligence, advanced sales and policy administration. She has an extensive history in helping advisors and wholesalers position insurance products, specifically: IUL, GUL, and VUL. Today, Ramona is President, of Living Benefit Review, LLC. This company provides independent, impartial, competitive intelligence services for LTC life insurance solutions: Hybrid products, Chronic Illness, Critical Illness and LTC riders. Prior to the insurance industry, Ramona served as an Information Manager in the Ohio Air National Guard where she was awarded the Air Force Achievement Medal. She has a Bachelor of Arts degree from The Ohio State University, in Psychology and Communication.

11:30 a.m. - 1:30 p.m. | ZOOM WEBINAR

MEMBER: (includes NAIFA, FSP, WIFS, LAAHU, NAHU, CAHU, VCAHU): $15.00

NON-MEMBER GUESTS: $20.00

www.naifala.org | 213-500-4946 | janet@naifala.org

.png)

.png)